Property Taxes By State

How Property Taxes Can Impact Your Mortgage Payment

When buying a home, property taxes are one of the expenses that can make a significant difference in your monthly payment. Do you know how much you might pay for property taxes in your state or local area?

When applying for a mortgage, you’ll see one of two acronyms in your paperwork – P&I or PITI – depending on how you’re including your taxes in your mortgage payment.

P&I stands for Principal and Interest, and both are parts of your monthly mortgage payment that go toward paying off the loan you borrow. PITI stands for Principal, Interest, Taxes, and Insurance, and they’re all important factors to calculate when you want to determine exactly what the cost of your new home will be.

TaxRates.org defines property taxes as,

“A municipal tax levied by counties, cities, or special tax districts on most types of real estate – including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.”

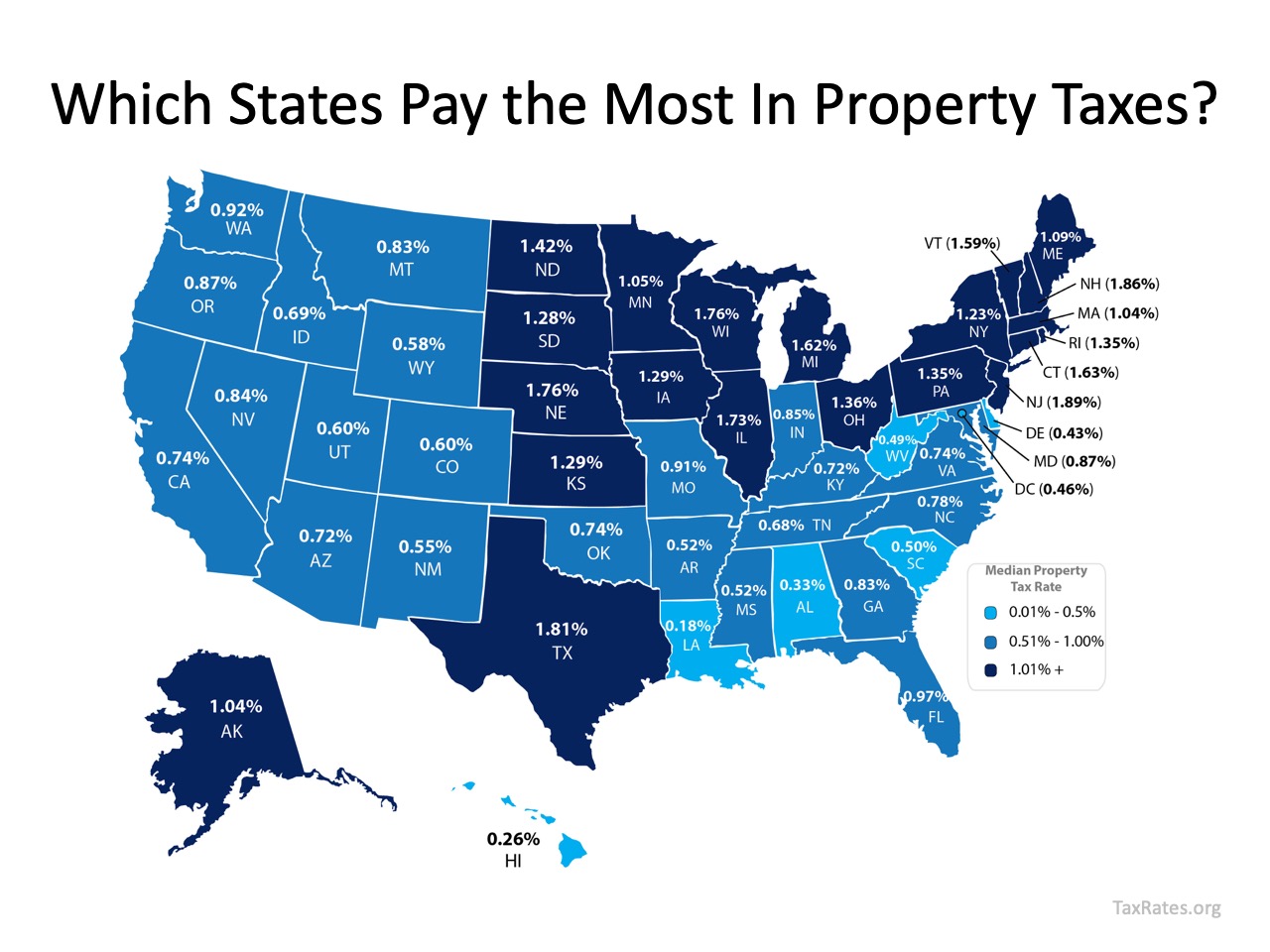

This organization also provides a map showing annual property taxes by state (including the District of Columbia), from lowest to highest, as a percentage of median home value.

Median Property Taxes – Best and Worst States

The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

So, depending on where you live, property taxes can have a big impact on your monthly payment. To make sure your estimated taxes will fall within your desired budget, let’s get together today to determine how the neighborhood or area you choose can make a difference in your overall costs when buying a home.

Naples Florida Real Estate News

Naples Golf Guy Monthly Market Report – New

NABOR’s Naples Area Market Report

Collier County Real Estate Transactions Week of July 1st 2019

Begin Your Naples Property Search

Begin Your Naples Property Search

So, if you’re ready to begin your search for your Naples home, or a southwest Florida Luxury home or condo, we encourage you to explore our website to find information about communities in the area. If golf is your game, we specialize in golf community real estate and would be happy to help you navigate the more than 150 different golf communities in our area. If you prefer a more direct approach, we will provide a list of properties that meet your criteria and/or communities that meet your needs.

Also, if you are considering new construction, remember the contractor’s real estate agent represents the builder’s best interest, not yours. There is no cost for you to have an agent represent you. In fact, we may be able to help you save money and negotiate for extras which the builder may not let you know about.

Lastly, we will handle all contract negotiations for your property from offer to close!

Bottom Line:

If you’re looking for a focused and goal-oriented real estate representative in Naples, Bonita Springs, Estero or Fort Myers who will help you achieve your Real Estate needs, please reach out to us directly. Additionally, if you are looking for a golf community expert or you are considering buying or selling a home, a luxury home, vacation home, golf home or dream home, call us or text us at 239-370-0892 or email Matt at Matt@NaplesGolfGuy.com

About Naples Golf Guy

Contact Matt: Matt@NaplesGolfGuy.com

September 3rd, 2019, Posted by NaplesGolfGuy