Myths Holding Back Home Buyers

2 Myths Holding Back Home Buyers

There are a couple of reasons home buyers are waiting to buy a home. Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

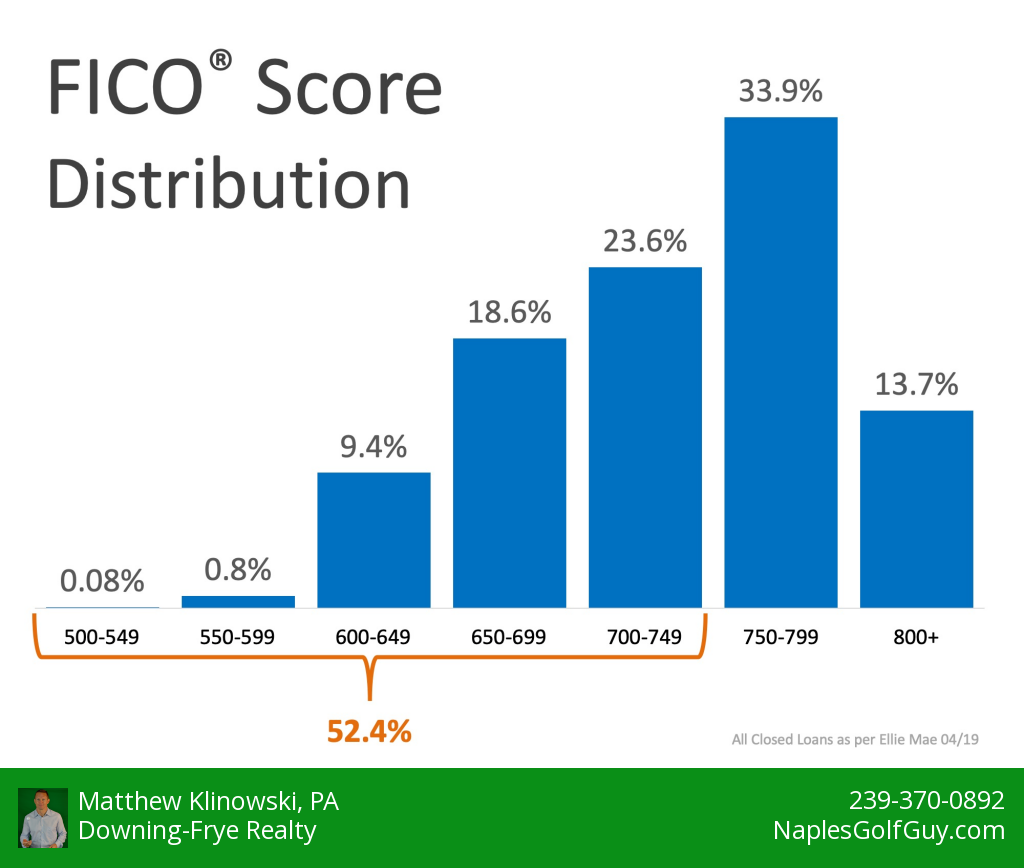

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

So, whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Begin Your Own Property Search:

Begin Your Own Property Search:

So, if you are ready to buy your dream home or vacation home in Southwest Florida, we encourage you to explore our website to find information about communities in the area. If golf is your game, we specialize in golf community real estate and would be happy to help you navigate more than 150 different golf communities in our area. If you prefer a more direct approach, we will provide a list of properties that meet your criteria and/or communities that meet your needs.

Also, if you are considering new construction, remember the contractor’s real estate agent represents the builder’s best interest, not yours. There is no cost for you to have an agent represent you. In fact, we may be able to help you save money and negotiate for extras which the builder may not let you know about.

Lastly, we will handle all contract negotiations for your property from offer to close!

Bottom Line:

Home buyers looking for a focused and goal-oriented Realtor in southwest Florida who will help you achieve your Real Estate needs, please reach out to me directly. Additionally, if you are looking for a golf community expert or you are considering buying or selling a home, luxury home, vacation home, golf home or dream home, call me or text me on my mobile phone at 239-370-0892 or email me at Matt@NaplesGolfGuy.com

About Naples Golf Guy

Contact Matt: Matt@NaplesGolfGuy.com

June 10th, 2019 Posted by NaplesGolfGuy